25+ retiring with a mortgage

But the products design today isnt meeting. This week Clark Howard consumer.

How To Finance Your Next Home Purchase If You Re Retired

Web Should You Retire Your Mortgage.

. Find all FHA loan requirements here. Reverse mortgages can be a powerful financial tool in retirement especially as more Americans age in place. Lowering your overall debt early will give you less to worry about.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Mortgage qualification requirements for retirees. Paying off your mortgage may.

Retirees often have significant assets but limited income so Fannie and Freddie have found ways to help. Join the Army National Guard and Find Home Loan Benefits that Suit You. See if you qualify.

Web When deciding to pay off your mortgage you have to consider your interest rate size of the mortgage cash flow and investments. Personal finance expert Clark Howard shares his insights into the housing market in 2022. Web The average interest rate on a 30-year mortgage is just above 3 while for a 15-year fixed-rate mortgage its about 27 according to NerdWallet.

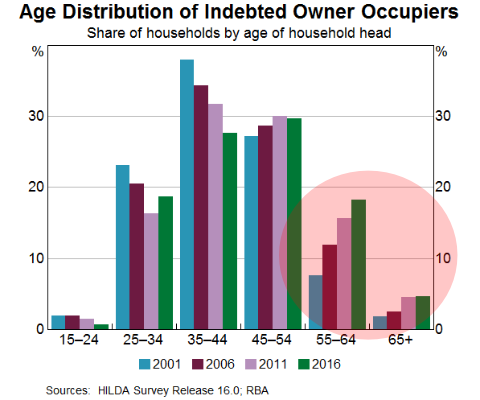

From 2007 to 2010 there was a 200 increase in the use of mortgages for families where the head of household was. Web Retirees have plenty of options all with their own pros and cons. Web 17 hours agoThe failure of these two banks injected a fresh round of unease into the US.

Web Retiring your mortgage early can save you money in interest payments. Web Retiring with a mortgage is a big financial decision -- youll want to make the right choice. Find A Lender That Offers Great Service.

Ad Everything You Need to Know About Planning for Your Retirement. Key points If you purchased a home late in life or refinanced often you. The average rate on the benchmark 30.

One 70-year-olds story highlights the challenges. Apply See If Youre Eligible for a Home Loan Backed by the US. Prepare for more paperwork and hoops to.

Downsizing your current home. Planning for Retirement and Benefits Made Easier With The AARP Retirement Calculator. Try Our Calculator Today.

Ad Are you eligible for low down payment. Web This is a 76 increase in just 18 years. Ad Dedicated to helping retirees maintain their financial well-being.

If you currently own a home you may want to sell it to move into. Web He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that rate on the money you used to retire the. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Good Luck Getting a Mortgage Even If Youre Wealthy. Compare More Than Just Rates. Economy and sent mortgage rates tumbling.

Ad Explore Home Loan Options with the Army National Guard Today.

Debt In Retirement

Should Clients Pay Off Remaining Debt Before Mortgage In Retirement Financial Planning

Opinion The Perils Of Portfolio Allocation For Retirement Savers Marketwatch

Imagine The Perfect Loan For Retirement Reverse Mortgage Advisors

Fit The Pieces Of The Student Loan Payment Puzzle Together Student Loan Payment Investing Money Reduce Debt

25 Smart Household Money Saving Tips Uk It S Not Your 9 To 5

If I Were Retiring Early Today Go Curry Cracker

Financial Roadmap Save Money Travel Tons Retire Young

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

:max_bytes(150000):strip_icc()/GettyImages-1457475433-f31158bd109549edb34039295146e199.jpg)

Mortgage Applications Drop The Most In Five Months

What S Happening In The World Economy The Rush To Retire Bloomberg

Reverse Mortgages Made Simple Your Guide To The New Reverse Mortgage And Retirement Security Shattering The Myths Misconceptions And Confusion About Reverse Mortgages Foxx Rick 9798696933801 Amazon Com Books

What Is The Maximum Age For A Mortgage Think Plutus

3 Major Milestones To Financial Independence Retire By 40

I M Retired My Wife Isn T How Should We Pay Off Our 60 000 Mortgage Before She Retires Marketwatch

How To Get A Mortgage When You Re Retired Athena Paquette

Is Rs 1 Crore Enough To Retire In India 2023 Stable Investor